The ticking time-bomb in your trading

There are many ways a trader can make small changes that will unlock their true trading potential; tiny tweaks today can aid long term success.

Here we look at what can happen when a trader spends longer in losing trades than winning ones. We examine three biases that explain why a trader behaves that way, and we suggest three solutions to combat it.

Your disposition rate is how long you spend in winning trades versus losing trades. For example, if your winning trades average 15 minutes and your losing trades average 30 minutes, then your disposition ratio will be 0.5. The reason this is important is that it usually mirrors your risk: reward ratio (the size of your winners compared to the size of your losing trades).

In essence, spending twice as long in losing trades often means these trades lose twice as much as your winners are making.

Why might this happen?

The Endowment Effect

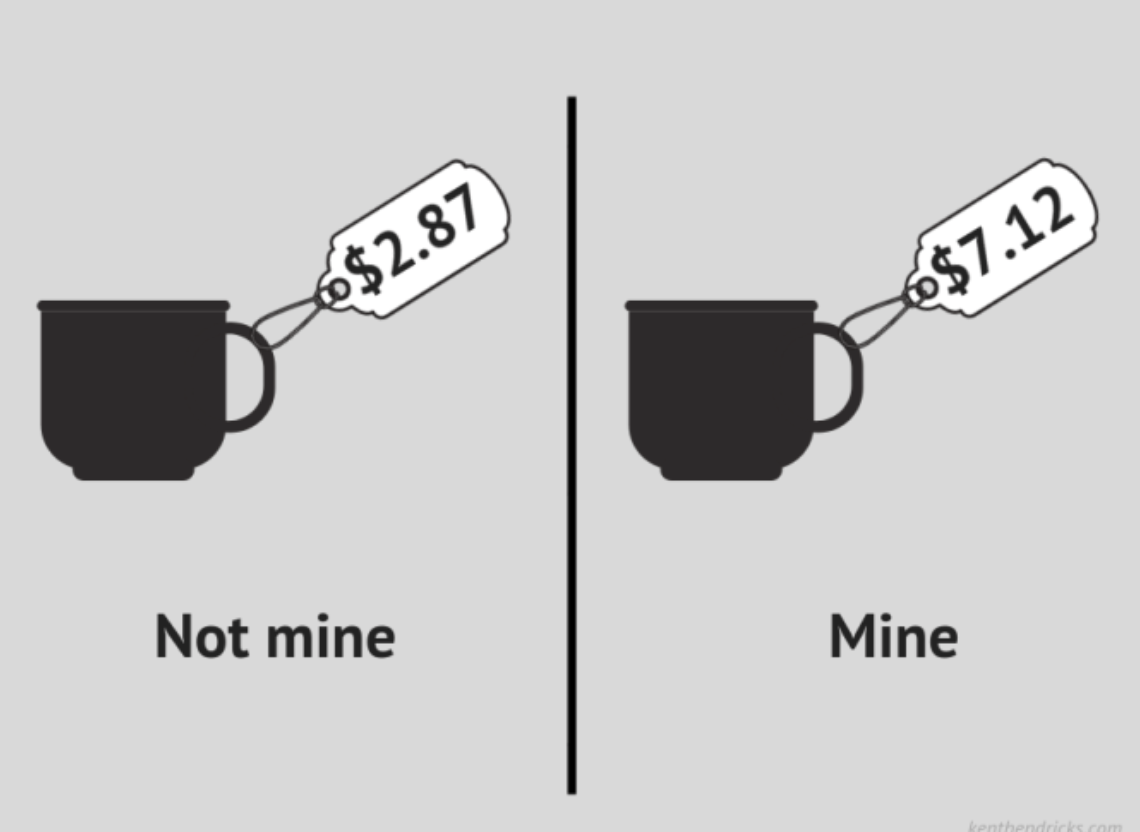

There is a tendency for people to demand much more to give up an object than they would be willing to pay to acquire it. Once we own something, we place a higher value on it, just because we own it.

For example, if you are in a shop, you might buy a watch for €150. A month later, someone compliments your watch and asks to buy it from you. Your price will be higher than €150.

The endowment effect is higher for physical items, but it also exists for intangible things, like trades, because people still feel they mentally own something. A large study done on stock traders in Australia. confirmed that the endowment effect was present. Day traders who were selling stocks appeared to value their own shares higher than buyers independent of current market price.

The sellers consistently placed sell orders 77% higher than market price compared to non sellers who placed ask orders 57% higher than market price.

Loss Aversion

We are afraid of losing. Our brain processes losses as 2.5 more painful than the gains made from winning, and so we spend much more time focusing on avoiding losses than we do on maximising wins.

Once a trader experiences the emotion of fear, they can change their trading strategy and make impulse decisions based on that fear.

In general, fear causes us to be risk averse, so a trader experiencing fear may play it too safe, and close winners earlier and sit on their account, not doing anything. They might also fail to close a losing trade, instead avoiding the decision and leaving the trade to potentially turn into a bigger loss. Read more about the impact of emotions on trading here

Optimism bias

We tend to believe things will work out better than they really do; our brains are hardwired to look on the bright side.

Even if as a society, or in a group, we think pessimistically, our private selves still think make positive assumptions about the future. This can be a very good thing, as optimism helps people both earn and save more, but it can also have negative consequences.

Traders typically make their decisions alone, and so are more in tune with their private selves. They can thus stay in losing trades too long because they believe they will turn around and eventually become winners, even if evidence and experience has shown them the contrary.

How does a trader work around these biases?

To work around the endowment effect, try reframing your trading decision. If you are considering whether or not to exit an existing long position, instead of asking, do I want to sell at this price, ask would I buy more of this trade at this price? This allows you to assess the true worth of the trade, without the endowment effect influencing you

To combat loss aversion, we recommend setting a trade loss limit so that if you are in a losing position, you don’t let it run so much that it puts a large dent in your trading capital. Additionally adding a daily loss limit, as extra protection can help you to take a break for the day, and to pause and reflect on your behaviour.

To avoid optimism bias, we recommend making predetermined commitments on when to close winners and close losers, thus minimising the chance of the optimism bias slipping you up in the moment, because you’ve made a commitment to yourself on how to act. Setting guardrails ahead of time will allow traders to stick to a trading plan, and not allow behavioural biases sabotage the end results and goals.

To recap, a low disposition rate can be explained by three behavioural biases:

• The endowment effect

• Loss aversion

• Optimism bias

The way to work around them is through:

• Reframing

• Setting loss limits

• Setting predetermined guardrails