Looking at the not so obvious

In our last blog, we looked at your most traded product, and showed you how to take advantage of strengths and manage around weaknesses. We saw that often your most traded product is not your best product, and may even be your worst.

If you’ve evaluated your most frequent product, your next step is to delve deeper into the other products you trade.

This blog looks at your secondary products - these are the products you trade less frequently, but could still impact your overall outcomes.

Can these edge case products be ignored, or do they actually generate an edge for traders?

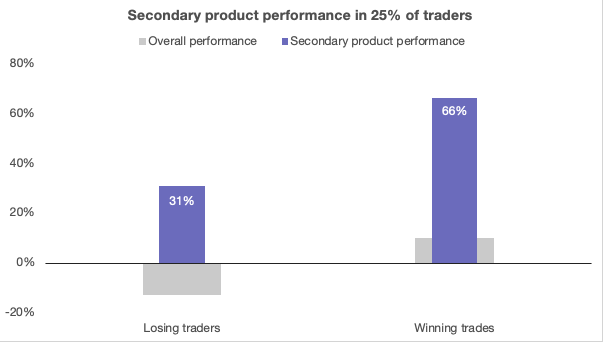

We analysed over 20,000 traders to determine the answer to this. 1 in 4 traders are trading a secondary product that has significant positive edge. This is true for both losing traders and winning traders.

So to summarise - yes, secondary products matter. How can we use this information to improve our own trading experience?

For 1 in 4 winning traders, trades in a secondary product give 6 times better returns than their average overall return.

For 1 in 4 losing traders, trades in a secondary product will be profitable.

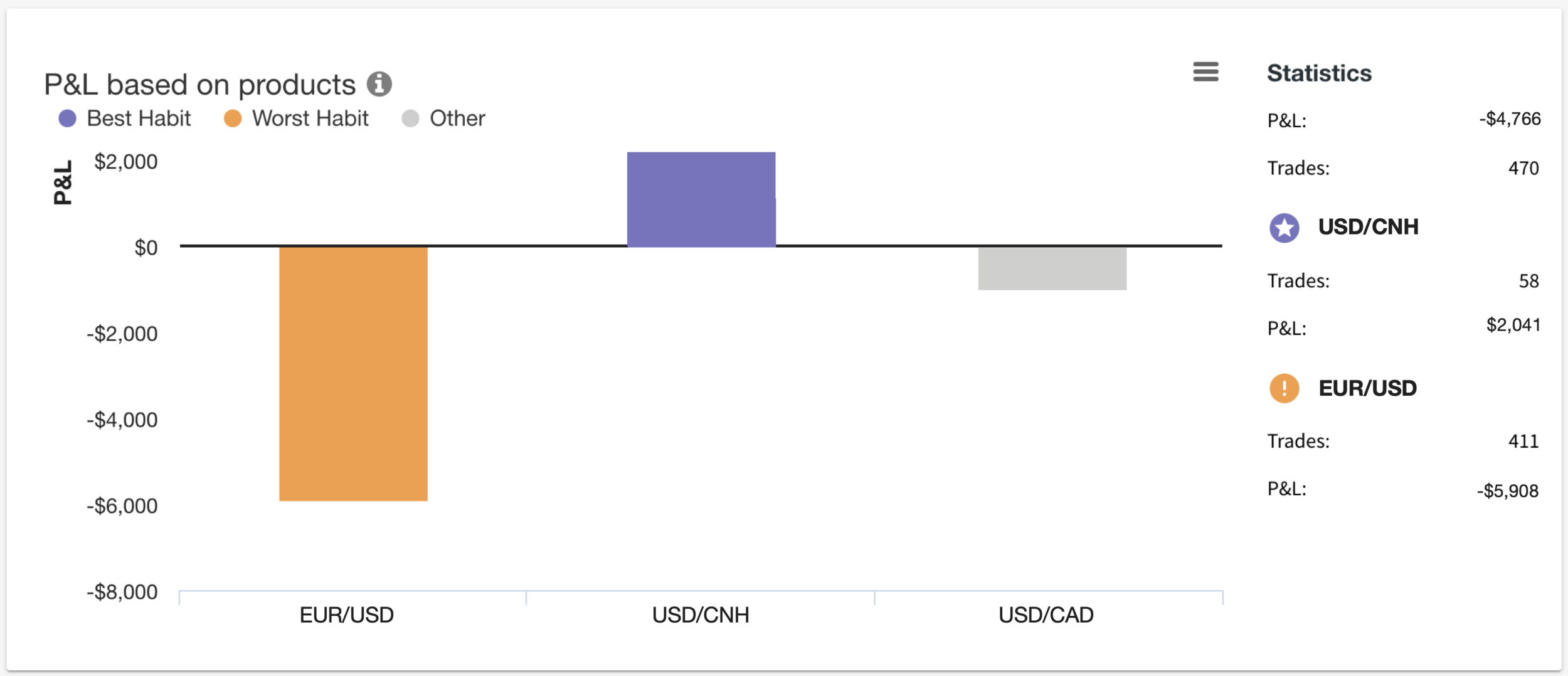

For this losing trader, the majority of their trades is in EUS/USD, and yet it’s their worst habit and losing them a substantial amount of money. In comparison, their best product they only trade less than 15% of the time, yet it is making this losing trader money.

For this winning trader, they trade in their best product less than 10% of the time, but it makes them almost half of their P&L amount.

We cannot determine why each individual trader may show a strength in their secondary products, but there are behavioural reasons we can offer up to explain:

· Traders are more careful with discipline on products they are not as familiar with (there is no overconfidence bias at play).

· Traders don't use their less frequent products as bored trades, or as quick tests of the market.

· Traders don’t use their least frequent trades in emotional trades, minimising the potential detrimental effects of losing streaks and revenge trading.

If you trade, you need to spend time analysing your own behaviour, and see if and why you are effective with a secondary product. It can be easy to focus on your bad habits and weaknesses, but it is just as important to focus on the good outcomes, and areas of strength. Your best trades deserve as much attention as your worst trades, and a continuous analysis of good trades will develop your muscle memory for these types of trades in the long run.