Streaking through your profits

How often have you thought you were on fire after a string of winning trades, only to lose big on the next trade you opened?

How often have you kept trading after multiple losses in a row, and continued to deplete your P&L in those subsequent trades?

Being in a streak can change your behaviour. The trades you enter after being in a losing streak or a winning streak are often very different to the trades you make when neutral. The emotions you carry with you, either from winning or losing, can impact the trading choices you make in later trades.

Do you have an edge after a streak? Check now here.

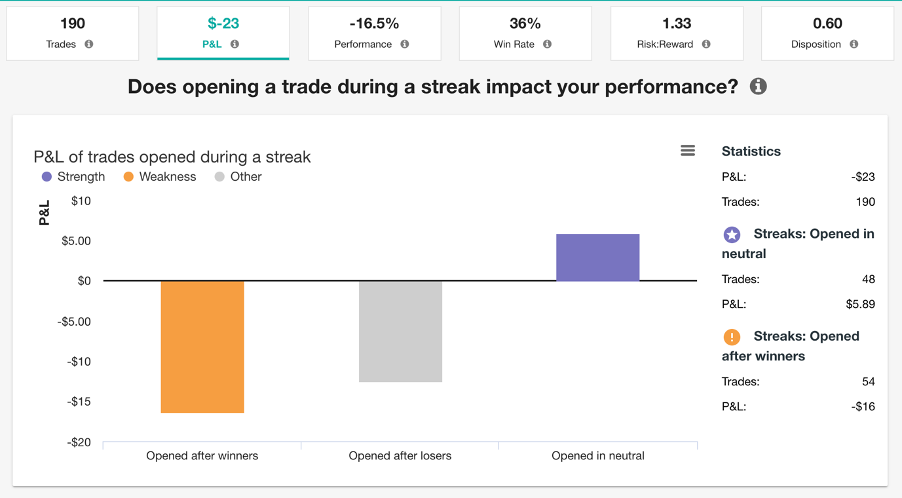

Here is a trader who is losing money when he opens trades after a losing streak. This is common in a lot of traders. What is the reason behind this? Losing streaks can cause the loss aversion bias to come into effect, where we put more weight on avoiding a loss than getting a win, causing erratic and revengeful trading.

Loss aversion is the disproportionate value we assign to losing. It’s a normal behaviour that is programmed in almost all human beings, and it’s due to the impact of a loss being stronger than that of a win, so we fear losing more.

This fear of losing causes us to drift away from logical and rational behaviour, and instead we act emotionally and impulsively. This can cause a lot of problems in trading, where impulsive decision making can be very costly.

Maybe you have a weakness in trades opened after winners, like this trader here. This losing trader would have a positive P&L if he only opened trades when in neutral. He is losing money when he opens trades after a winning streak. Why does that happen? Winning streaks can cause us to be overconfident and make rash decisions, ignoring obvious red flags because we over-inflate our skills and intuition. The overconfidence bias has a negative affect on P&L’s because it tricks you into believing you know more about the trade you are going to make than you really do, lulling you into a false sense of security that can greatly cost you.

Both winning and losing streaks can cause us to make decisions based on emotion. This sometimes can be a positive, but often emotional trading has a negative impact on your P&L.

If you are someone who has a weakness in trades opened after a streak, we recommend the following steps:

Learn to understand how both winning and losing streaks affect your behaviour by measuring the performance of these trades here.

In the short term, avoid trading when you have had more than 2 losses or wins in a row, so that you can reset your emotions and mentality.

Longer term, train yourself to use your emotional signals to replace your instinctive reaction with the rational one. Practice this by recognising and acknowledging your emotions when you have a run of winners or losers.

Read More on your trading edges:

In the first of our series about exploring your trading edges, we look at the number of products a trader trades, and how this impacts profitability.

In the second, we explored whether your most traded product is really your best.

In the third, we looked at products you don’t trade that often, and how they impact your performance.

In the fourth, we looked at how the time of day you do your trading can impact your returns.

In the fifth, we examined the difference in your first trade of the day, against the rest of your trades